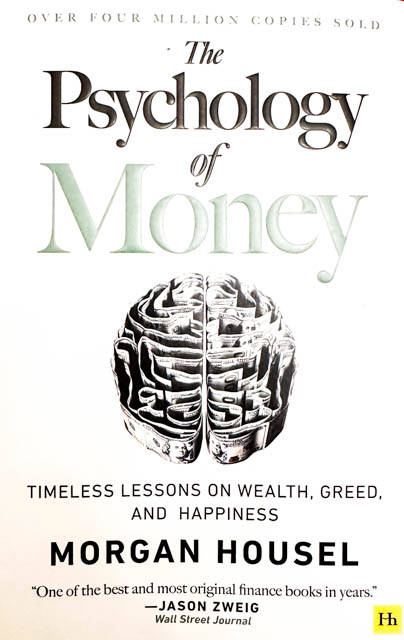

I don’t know much about money, but this is an accessible and interesting way to start thinking about it. It is very readable, with short chapters and relatable writing style, without being too technical. It gets into the personal, emotional, cultural, an behavioral aspects of money, which to me felt very relevant, and not the usual approach.

I particularly appreciated the last chapter, which is a historical overview about money that helped me understand how the relative income equality of the 50’s devolved into the blatant income inequality we see today.

Here are some bits I highlighted to share with you:

- “If you risk something that’s important to you for something that is unimportant to you, it just does not make sense.”

- “‘Enough’ is realizing that an insatiable appetite for more will push you to the point of regret.”

- “$81.5 billion of Warren Buffet’s $84.5 billion net worth came after his 65th birthday.”

- “The only way to be wealthy is not to spend the money that you do have. It’s not just the only way to accumulate wealth, it’s the very definition of wealth.”

- Wealth isn’t just about income; it is about your ability to save and to control your emotions.

- “Wealth is hidden. It’s income not spent. Wealth is an option not yet taken to buy something later. Its value lies in offering you options, flexibility, and growth… It’s hard, and requires self control.”

- “Things that have never happened before happen all the time.”

- “Only 27% of college grads have a job related to their major, according to the Federal Reserve.”

- “Long-term financial planning is essential… but it is hard to make long term decisions when your view of what you’ll want in the future is likely to shift.”

- “Between 1993 and 2012, the top 1% saw their incomes grow 86.1%, while the bottom 99% saw just 6.6% growth.”

My general feeling about The Psychology of Money is I want my kids to read it and I wish I had read it thirty years ago. The basic message here is to start early managing your money, and to stay steady in your approach for the long haul. How you manage your money is just as important as how much you make. I give this book 4 stars.