–

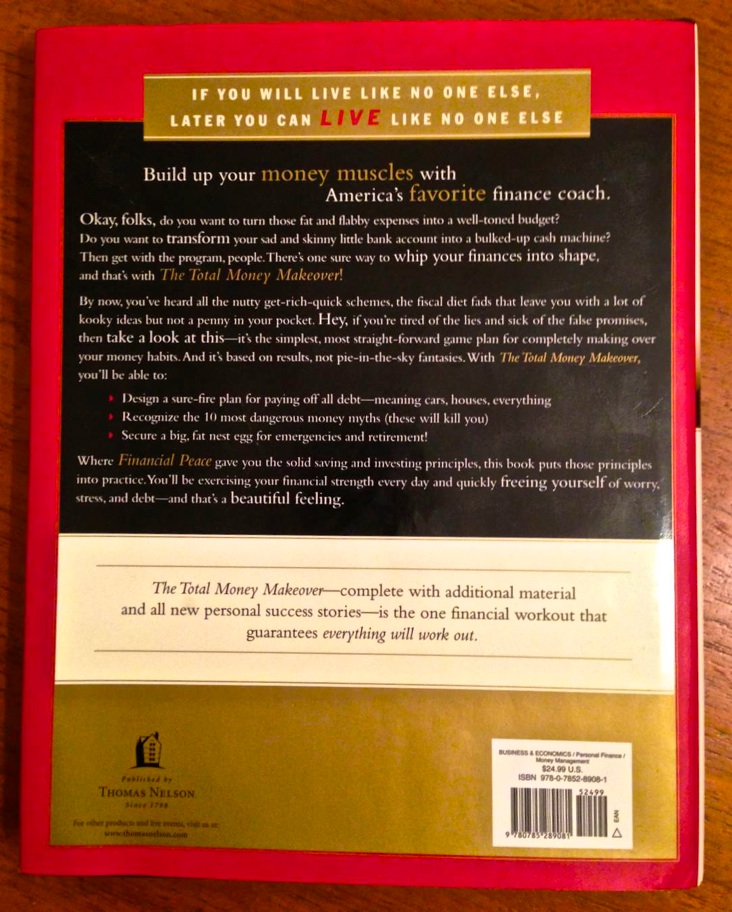

I couldn’t be more pleased that my husband and I read the above book together and have launched into a practical plan to get out of debt and find financial success. Dave Ramsey is a radio personality and the tone of this five star book has a little more hype to it than I go for, but the much needed information is excellent. Many times I found myself wishing we had this book decades ago! It will now be my go-to gift for college grads, because the earlier you get and act on this information, the more wonderful the compounded results.

Since both my husband and I are self-employed, budgeting has always been difficult since we never know what our income will be. Additionally, we live in an expensive area of the country and our three children have been a priority. Homeschooling was not inexpensive, then there were three sets of braces, and now we find ourselves half-way through the process of three going to college. But given my New Year’s resolution, I needed both a plan and then a way to work that plan to set our finances on a better track.

Dave Ramsey’s book clearly provides a great plan, but to achieve it we needed a budget. So to overcome our problems thinking about that in the past, my husband and I looked at our tax returns over the past several years and came up with a conservative estimate of what we have made each year. We divided that number by 12 and are giving ourselves that amount each month to budget within.

Not an excel whiz, and wanting something I could keep track of on my phone as well, I started researching budget apps. An app called Mint is popular (and free) but did not provide the budget planning needs we were looking for; it deals more in syncing with your actual accounts and seeing how you spend your money. Dave Ramsey and others have good services, but charge monthly subscription fees, and I didn’t want to pay indefinitely for my budget platform.

Then I found YNAB which stands for You Need A Budget. Check it out here. There was a month-long free trial and then costs a one-time $60 purchase fee. We tried it out, and then bought it; we are very happy with what it offers. Exactly what I was looking for, it is a very simple but flexible system. We can work it from my computer or our iphones. We have virtual envelopes for categories, and an easy way to input every last penny against those amounts. If you go over what you budgeted in any category, you can juggle things to compensate, or surpluses and deficiencies can automatically be carried to the next month.

What a sense of power, hope, and control this gives! We can see our progress toward debt-free goals that we now recognize are not unrealistic– just some direct focused effort is required. If you are living with credit card debt, or living hand to mouth, or a not educated about money, I cannot recommend highly enough the combination of this book and app. And the sooner the better!

It may be a while off, but maybe I’ll eventually be able to afford to do some international travel. I find that possibility very compelling. As Dave says, “Live like no one else, so you can live like no one else!”

–